Innovative Directions in Alternative Investing

Founded in 1994, Lexington Partners is one of the world’s largest managers of secondary private equity and co-investment funds with over $75 billion in committed capital.

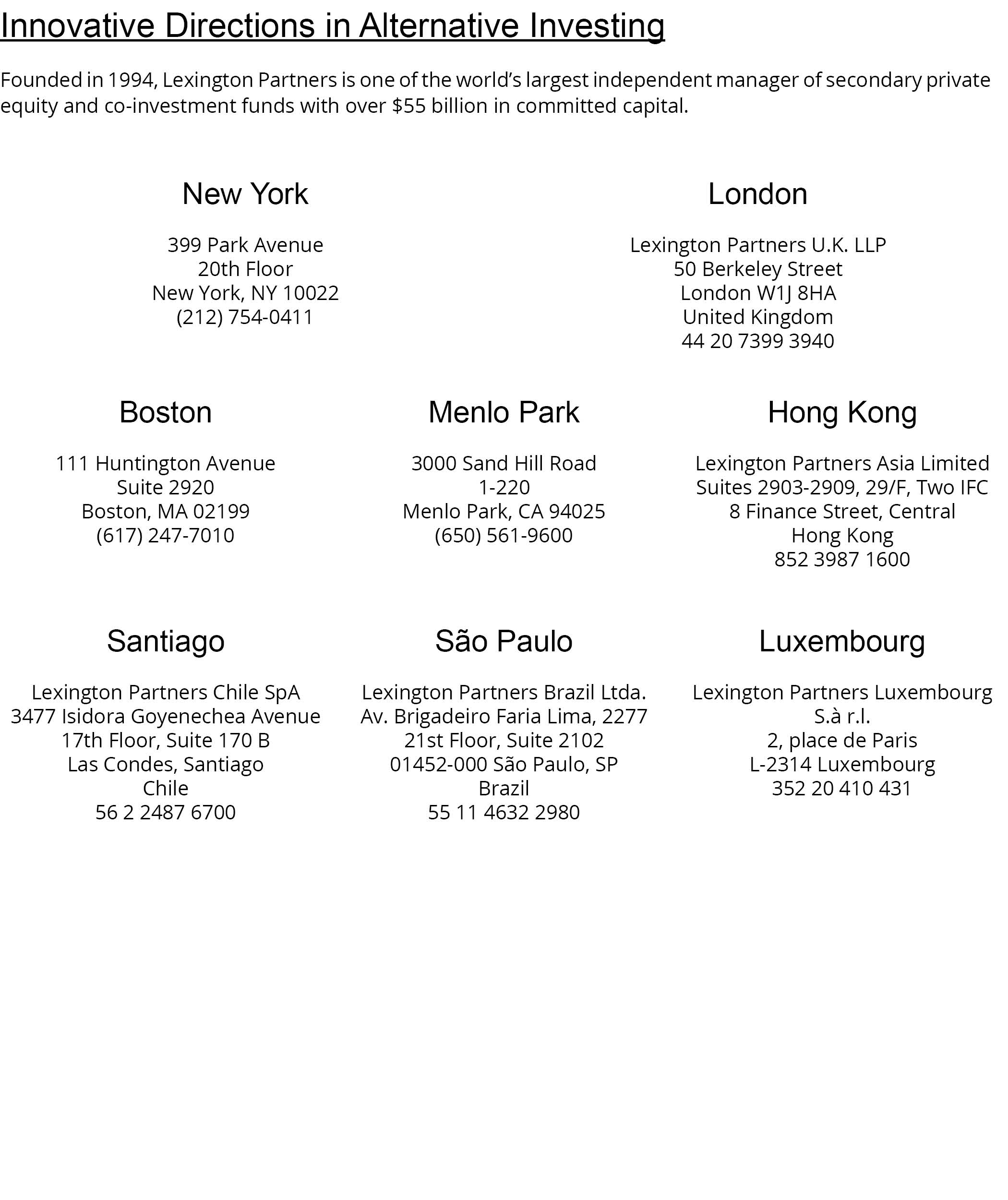

New York

London

Boston

Menlo Park

Hong Kong

Santiago

São Paulo

Luxembourg

New York

London

Boston

Menlo Park

Hong Kong

Santiago

São Paulo

Luxembourg

Hildred Capital Announces Close of Multi-Asset Continuation Fund with Capital Commitments in Excess of $750 Million

New York - March 28, 2024 Fund was oversubscribed with robust backing from existing limited partners and significant support from a diverse base of new institutional investors. Hildred Capital, (“Hildred”) a healthcare-focused private equity firm that specializes in...

Wellspring Announces Closing of $975 Million Continuation Fund Partnering with Lexington Partners, Neuberger Berman, Hamilton Lane and AltamarCAM

New York - March 27, 2024 Wellspring Capital Management Group LLC (“Wellspring”) today announced the close of a $975 million multi-asset continuation vehicle that has acquired interests in three assets – Supply One, Cadence, and Pentec Health – from Wellspring Capital...